how much federal tax is taken out of my paycheck in illinois

FICA taxes consist of Social Security and Medicare taxes. Personal income tax in Illinois is a flat 495 for 20221.

State W 4 Form Detailed Withholding Forms By State Chart

Both employers and employees are responsible for payroll taxes.

. Only you as the employer are responsible for paying. However each state specifies its own tax rates which we will. This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Total income taxes paid. However they dont include all taxes related to payroll. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck.

For the employee above with 1500 in weekly pay the calculation is 1500 x. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. You are able to use our Illinois State Tax Calculator to calculate your total tax costs in the tax year 202122.

If your monthly paycheck is 6000 372 goes to Social Security and 87 goes to Medicare leaving you with 6000 372 87 5541. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Our calculator has been specially developed in order to provide the users of the calculator with not only.

That 14 is called your effective tax rate. That means your winnings are taxed the same as your wages or salary. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck.

Taxpayers can choose either itemized deductions or the standard deduction but usually choose whichever results in a higher deduction and therefore lower tax payable. Employers in Illinois must deduct 145 percent from each employees paycheck. Our online Weekly tax calculator will automatically.

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. You can claim a tax credit of up to 54 for the state unemployment tax you pay.

The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income Tax Rates and Thresholds in 2022. There are two state taxes to be aware of in Illinois. The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022.

For the employee above with 1500 in weekly pay the calculation is 1500 x 765 0765 for a total of 11475. According to some changes in the W-4 Employee Withholding Certificate find out more about that here earnings that are too low might not have their income taxes withheld at all. Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding amount its not that easy.

Unlike Social Security all earnings are subject to Medicare taxes. You must report that money as income on your 2019 tax return. For example lets say you elected to receive your lottery winnings in the form of annuity payments and received 50000 in 2019.

Personal Income Tax in Illinois. For 2022 employees will pay 62 in Social Security on the first 147000 of wages. If no federal income tax was withheld from your paycheck the reason might be quite simple.

Given that the second tax bracket is 12 once we have taken the previously taxes 9950 away from 27450 we are left with a total taxable amount of 17500. However making pre-tax contributions will also decrease the. Pay FUTA unemployment taxes which is 6 of the first 7000 of each employees taxable income.

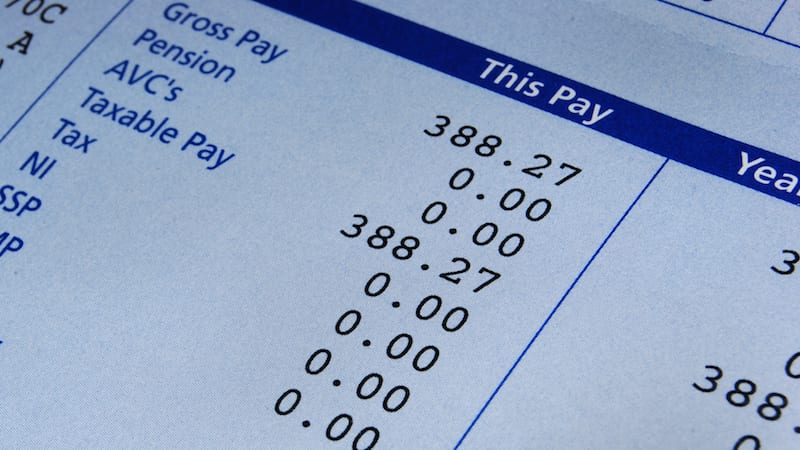

FICA taxes are commonly called the payroll tax. Amount taken out of an average biweekly paycheck. Personal income tax and unemployment tax.

These amounts are paid by both employees and employers. Illinois Hourly Paycheck Calculator. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid more than 200000 are set by the IRS.

And you must report the entire amount you receive each year on your tax return. Employees who file for exemption from federal income tax must still have Medicare taxes withheld from their payroll checks. Thats the deal only for federal.

If you increase your contributions your paychecks will get smaller. You didnt earn enough money for any tax to be withheld. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

The total bill would be about 6800 about 14 of your taxable income even though youre in the 22 bracket. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator.

Use tab to go to the next focusable element. The Medicare tax rate is 145. After taking 12 tax from that 17500 we are left with 2100 of tax.

Amount taken out of an average biweekly paycheck. Given that the first tax bracket is 10 you will pay 10 tax on 9950 of your income. Switch to Illinois hourly calculator.

For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. How do I calculate how much tax is taken out of my paycheck. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible.

Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. Details of the personal income tax rates used in the 2022 Illinois State Calculator are published below the. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you.

This comes to 995.

Illinois Paycheck Calculator Adp

Illinois Paycheck Calculator Smartasset

How Much Should I Set Aside For Taxes 1099

Paycheck Calculator Take Home Pay Calculator

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How Many Tax Allowances Should I Claim Community Tax

Here S How Much Money You Take Home From A 75 000 Salary

State W 4 Form Detailed Withholding Forms By State Chart

2022 Federal State Payroll Tax Rates For Employers

Why Illinois Is In Trouble 109 881 Public Employees With 100 000 Paychecks Cost Taxpayers 14b

Understanding Your Teacher Paycheck We Are Teachers

Tax Withholding For Pensions And Social Security Sensible Money

Free Online Paycheck Calculator Calculate Take Home Pay 2022

I Have A Monthly Wage Of 1 000 But Need To Pay Tax At 220 So I Just Have 780 In The End Is This Kind Of Tax Rate Common In Illinois Quora

Understanding Your Pay Statement Office Of Human Resources

Illinois Paycheck Calculator Smartasset

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Irs Tax Refund Status Illinois Residents Still Waiting For Federal Tax Refunds 9 Months After Filing Abc7 Chicago