bank of america class action lawsuit mortgage

Bank of America destroyed documents as borrowers tried to save their homes suit says By Deon Roberts Updated June 05 2018 1210 PM A new lawsuit says Bank of America jerked around borrowers. July 12 2013 - by Lucy Campbell.

How Do You Benefit From A Class Action Lawsuit Lawyer Ben Crump

The Court has not decided which side is right.

. Bank of America NA. Hagens Berman Sobol Shapiro LLP a national consumer-protection law firm has filed a class action lawsuit alleging that Bank of America NYSE. Class Action Lawsuit Against Bank of America Mortgage Fraud November 11 2021 by Evelyn Bank of America mortgage holders filed class action lawsuits against Countrywide and Wells Fargo.

Bank of America NA. Plaintiffs in a class action lawsuit allege Bank of America charged its customers improper fees systematically in a multipronged effort to earn more profit. A consumer banking deceptive practices class action lawsuit has been filed alleging that Bank of America NYSEBAC created and headed an illegal enterprise designed to defraud homeowners seeking loan modifications as part of the government Home Affordable Modification Program or HAMP.

Bank of America denies all acts of wrongdoings however they have agreed to settle the class action lawsuit in order to avoid the further risk and cost of ongoing litigation. CN - More than 100 Florida homeowners claim Bank of America fraudulently delayed or destroyed their applications to modify the terms of their mortgages to steal their homes and sell them at a profit. Has been hit with a proposed class action lawsuit over a host of alleged policies and actions a North Carolina consumer claims have harmed mortgage loan borrowers nationwide.

Suing Bank of America for Data Breach In January 2021 a class-action lawsuit was filed in federal court in San Francisco against Bank of America. Mortgage Bank of America NA. These were class action lawsuits because they took the effort to inform class members of their rights under the FHA rules in a non-violent way.

Last year Bank of America settled a lawsuit brought by a former employee of a bank contractor who. A Virginia couples proposed class action lawsuit alleges Bank of America NA. The plaintiff alleges Bank of America created and opened in late 2019 an escrow account for her mortgage.

The plaintiffs further say multiple BOA fees would get charged for a single transaction. Fails to honor agreements with mortgage borrowers to modify their loans to prevent foreclosure for a variety of bogus reasons which include the case says a notary failing to write his or her middle initial on financial documents. Bank of America Class Action 250M Deal Reached Follow Article By Steven Cohen February 24 2020 A 250 million settlement has been proposed in a class action lawsuit filed against Bank of America and Countrywide Financial Corp by mortgage borrowers who claim that the two companies participated in a real estate appraisal scheme.

As such the class action lawsuit is seeking damages and restitution for the allegedly deceptive transfer fees unjust enrichment and violations of state business practice laws on behalf of a proposed nationwide class of Bank of America account holders. Class Action Outlines Alleged Pervasive Mistreatment Of. The lawsuit claims that Bank of America violated the Consumer Privacy Act and Unfair Competition Law and was negligent towards Employment Development Department EED debit cardholders.

The plaintiff alleges Bank of America created and opened in late 2019 an escrow account for her mortgage without consent or authorization to do so. By Consider The Consumer on 07022021 Bank Of America And Other Banks Probed For Alleged Misdeeds Towards Mortgage Holders Officials have opened up an investigation looking into the alleged Mortgage misconduct committed by the Bank Of America and other banks against their customers possibly leading to a class action lawsuit. District court western district of washington seattle no.

According to the lawsuit Bank of America negleted to present documentation that their mortgages had been fully satisfied. 10-00488 on behalf of homeowners alleging that bank of america reneged on a promise to modify troubled mortgages as a condition to accepting twenty five billion dollars of federal bailout money according to a class. BAC created and headed an illegal enterprise designed to defraud homeowners seeking loan modifications as part of the governments Home Affordable Modification Program or HAMP.

If you had a mortgage prior to January 1 2009 and applied to BOA for a mortgage modification between January 1 2009 and December 31 2016 you may have been a. Life Insurance Billing Fraud. In a 300-page federal complaint filed Tuesday in Orlando the homeowners say Bank of America is guilty of fraud and unfair business.

In 2010 Arizona and Nevada sued Bank of America for mishandling modification applications. A class action lawsuit was filed againstbank of america in us. If you are a class member who was the mortgagor party to a residential mortgage on real property located in new york state serviced by bank of american for which all authorized principal interest and all other amounts or otherwise owed by law was completely paid between july 12 2010 and november 27 2015 but bank of america failed to present a.

The Class Action lawsuit refers to an instance in which several hundred or even a few thousand plaintiffs receive a claim for compensation after being improperly and repeatedly denied of their right to file a loan modification with the bank of America. The Action challenges extended overdrawn balance charges EOBCs as allegedly violating the National Bank Acts usury limit. This class action lawsuit comes as the result of rampant mortgage fraud in the last few years.

In fact the second leading complaint was over the Chase practices of steering homeowners into FHA loans. Bank of America NA Case No. Has been hit with a proposed class action lawsuit over a host of alleged policies and actions a North Carolina consumer claims have harmed mortgage loan borrowers nationwide.

Bank of America Class Action 250M Deal Reached Follow Article By Steven Cohen February 24 2020 A 250 million settlement has been proposed in a class action lawsuit filed against Bank of America and Countrywide Financial Corp by mortgage borrowers who claim that the two companies participated in a real estate appraisal scheme. Did you have a Bank of America Mortgage. As reported by the Department of Justice the number one complaint filed last year was under the fraudulent activity category.

Bank Of America Fees Class Action Settlement To Stand Top Class Actions

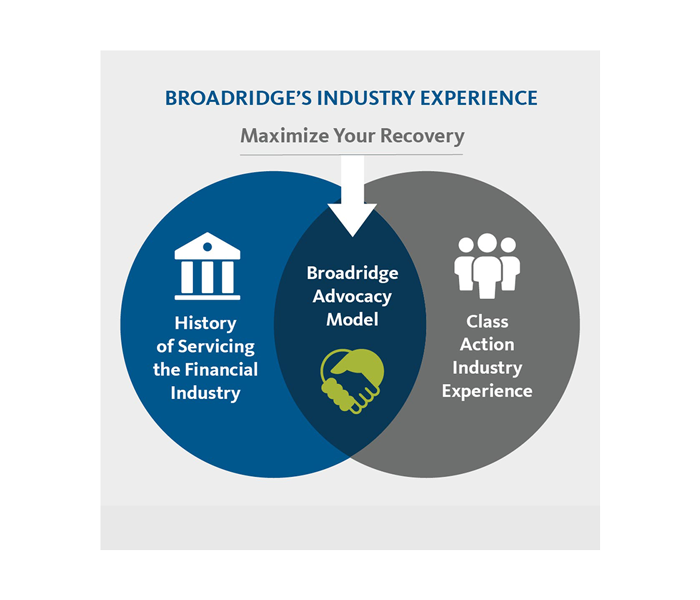

Global Securities Class Action Services For Wealth Management Broadridge

Most Famous Class Action Lawsuits Masstort Us

Boeing Sedang Terpukul Tiongkok Borong 300 Pesawat Airbus Dari Eropa Pesawat Udara Pesawat Eropa

Bank Of America Mortgage Modification Lawsuit

Eaglebank Seeks Final Court Approval Of Class Action Lawsuit Settlement Releases Earnings Washington Business Journal

Lawsuit Images Stock Photos Vectors Shutterstock

Fabio Passos On Twitter Citigroup Economy Agree

Bofa Bungled Covid Ue Benefits Lost Customers Thousands Of Dollars Says Class Action Top Class Actions

Class Action Report Levi Korsinsky Llp Securities Class Action Attorneys

Bank Of America 75m Improper Fees Class Action Settlement Top Class Actions

Class Action Lawsuits Help Advertisers Recover Damages For Ad Fraud

Bank Of America Class Action Claims Company Failed To Fulfill Promise To Refund Punitive Fees Top Class Actions

Student Loan Forgiveness Settlement Will Process 170k Applications Top Class Actions Small Business Loans Business Loans Student Loan Forgiveness

Robinhood Facing Class Action Lawsuit Over Suspended Gamestop Trading

Open Class Action Settlements With No Proof Of Purchase 2022 Sweepstakesbible Blog

No Proof Required Class Action Lawsuit Settlements April 2022

Mcdonald S Workers File Class Action Suit Alleging Culture Of Sexual Harassment